Lessons from Edward Tufte on the Art and Science of Financial Reporting for Ultra High Net Worth Clients

The realm of financial reporting, particularly for ultra-high-net-worth individuals (UHNWIs), demands not only accuracy but also clarity in presentation. Edward Tufte, a pioneer in data visualization, emphasizes that good design is crucial in making complex data comprehensible and actionable. In this context, Tufte’s principles offer invaluable insights for family offices and advisors who aim to communicate their client's complex financial data in an effective manner.

1. Keep it Simple (Simplicity and Clarity: The Core of Effective Design)

Tufte’s central tenet is the pursuit of simplicity without sacrificing the richness of information. For UHNWIs, financial reports encompass a vast array of data points, from asset allocations and investment returns to tax implications and estate planning. The challenge lies in distilling this information into a format that is not only digestible but also insightful.

By adhering to the principle of simplicity, financial reports should avoid clutter and focus on essential data. This involves using clear, concise headings, eliminating unnecessary jargon, and employing white space strategically to enhance readability. Charts and graphs should be used judiciously, ensuring they add value rather than overwhelm the reader. Tufte’s concept of “data-ink ratio” – the proportion of ink used to present actual data compared to the total ink used in a graphic – is particularly relevant here. High data-ink ratios ensure that visual elements serve to highlight the data rather than obscure it.

2. Know Your Audience

Tufte is famous for stripping away information and visualization elements down to their simplest form. This is what many people will call ‘less is more’. This is the opposite of what many family offices have done with their investment reporting.

The reports that you as a portfolio manager or member of the investment team would want can vary widely from what a family member would want to see. While you may find it incredibly important to understand the attribution and sources of your investment performance, the family member may just want a basic understanding of whether they are up or down financially. Do not confuse what information you would want to see with what the actual end consumer of the report would want to see. This means, in most cases, you are developing separate reports for internal use vs. external use. It may also mean that you may need to have different versions of your client reports depending upon the level of financial sophistication and generation of the family member.

Family offices can end up putting a tremendous amount of effort into creating large report books just for the family members to skip to the end of the report to see if they made money that period. It is important to know your audience and it starts by acknowledging you are not the target audience. While your opinion may interest you, it is irrelevant.

3. Narrative and Context: Telling the Financial Story

Tufte also underscores the importance of context in data presentation. Numbers alone can be dry and difficult to interpret. Embedding data within a narrative framework helps to contextualize the information, making it more relatable and meaningful.

In financial reporting, this could mean integrating historical performance data with market commentary, providing insights into how past events influenced portfolio performance. Visualizations (i.e. charts) can also help communicate a lot of information in a way that reduces the cognitive load on the user. The saying a picture tells the story of 1,000 words is certainly true when it comes to complex financial information. Tufte’s idea of “storytelling with data” ensures that clients not only see the numbers but also grasp their implications.

4. Embracing Complexity with Elegance

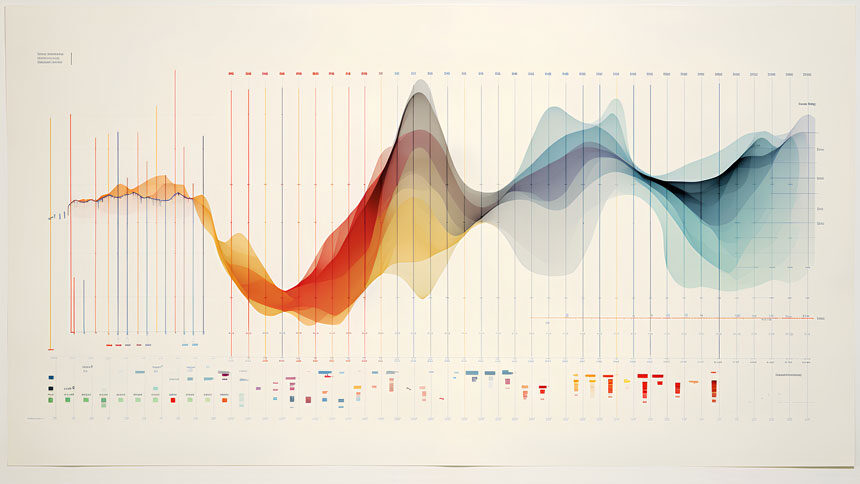

Sometimes no matter how hard you try to keep it simple, the fact of the matter is that your clients lead complex lives and have complex investment portfolios. Tufte advocates multivariate analysis to present such complex data elegantly. Multivariate analysis aims to identify patterns between multiple variables. This involves integrating different data dimensions into a single, coherent visual representation. Tufte was a huge fan of Charles Joseph Minard's 1869 graphic of Napoleonic France's invasion of Russia noting that it captures six variables in two dimensions.

For a financial reporting example, bubble charts can be particularly effective in this regard. A bubble chart allows three dimensions of data to be displayed simultaneously: the x-axis and y-axis represent two variables, while the size of the bubble represents a third variable. This type of chart can illustrate the relationship between investment returns (y-axis) and risk levels (x-axis), with the size of the bubbles representing the amount of investment in each asset class.

By using color coding and size variations, multiple variables can be communicated simultaneously, offering a holistic view without necessitating multiple separate charts. This not only saves space but also enables clients to see connections and correlations at a glance.

5. Visual Integrity: Honesty in Representation

Integrity in data representation is a cornerstone of Tufte’s philosophy. Financial reports must maintain honesty and transparency, avoiding manipulative graphics that could mislead clients. This involves using consistent scales in charts, presenting absolute numbers rather than selectively highlighting percentages, and ensuring that visual comparisons are accurate.

For example, bar charts should start at zero to avoid exaggerating differences, and time series graphs should use equal intervals to represent time accurately. Such practices build trust and ensure that clients can rely on the presented data to make informed decisions.

The Tuftean Legacy in Financial Reporting

Applying Edward Tufte’s principles to financial reporting for UHNWIs transforms data from mere figures into a powerful tool for decision-making. By prioritizing simplicity, embracing complexity with elegance, embedding data in narrative contexts, and upholding visual integrity, financial advisors can create reports that not only inform but also empower their clients.

In the intricate world of high finance, where decisions are often measured in millions, the clarity and precision of information design can make a profound difference. Tufte’s legacy provides a roadmap for achieving this, ensuring that financial data is not just seen, but truly understood.

At Risclarity, we are dedicated to upholding these principles in our financial reporting, ensuring that our clients receive the highest standard of clarity and insight in their financial information.

Resources: